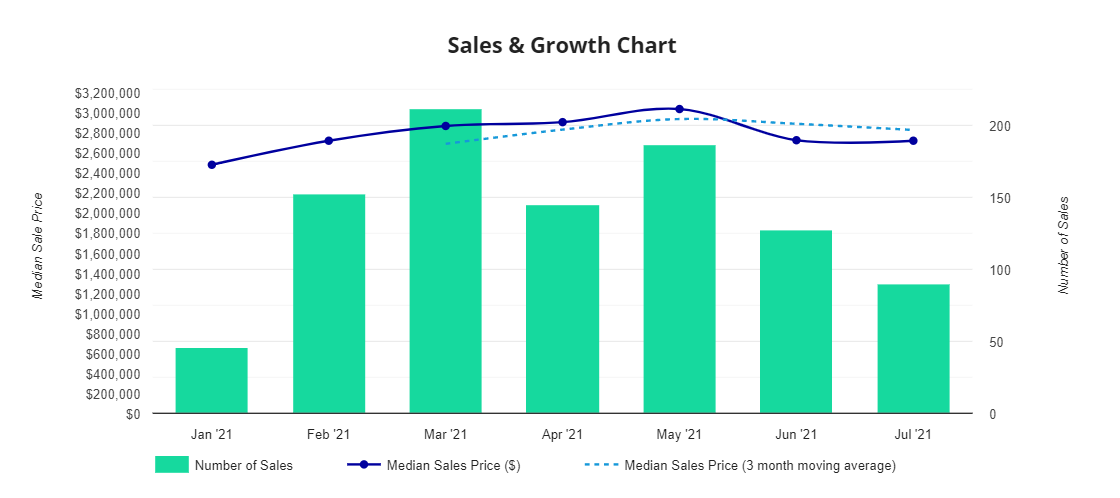

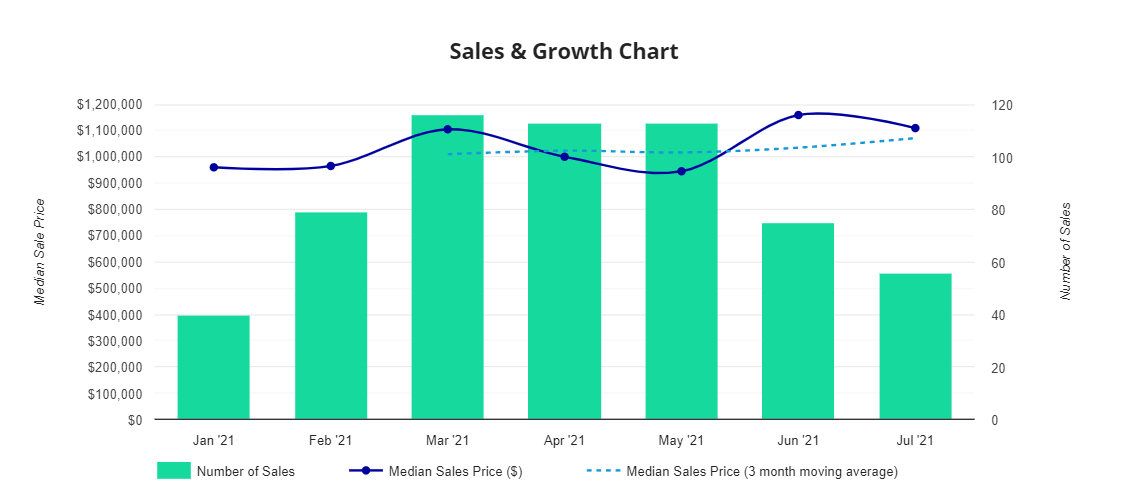

The first half of 2021 saw the pent-up demand for Sydney property from 2020 finally unleashed! Median house prices in Ku-ring-gai grew sharply, rising over 10% in Q1 and another 5% in Q2 (with some pockets seeing growth double that), auction clearance rates remained high and price records were broken. The median price for house in Q2 sat at $2,900,000 up from $2,222,500 12 months earlier. Growth in apartment prices was more subdued with the median for Q2 at $996,080 up from $943,000 12 months earlier. Positive economic forecasts, a booming stock market and continuing low interest rates suggested the positive conditions would continue throughout 2021. On the 26th June the rapidly spreading Covid-19 Delta strain forced Sydney into another lockdown and put a question mark on which direction the market would go.

Anecdotal reports suggest prices are holding firm, if not growing, and, unsurprisingly, the volume of listings has fallen sharply. July is seasonally a quieter month regardless of the impact of Covid-19 and many vendors are likely to have simply delayed their plans to focus on a Spring campaign. We have had to adapt to the changing conditions by implementing online auctions again, conducting virtual tours/appraisals and providing one on one inspections. This has allowed us to still achieve some great results, but will extensions to the lockdown mean this will be the new norm for the typically busy Spring selling period? And will vendors be willing to list if they cannot run a traditional auction campaign?

A locked down Spring will surely see a low volume of stock and demand outstripping supply to keep prices high. The end of lockdown, whether that be in Spring, Summer or not until 2022 could result in a reversal of this situation with a flood of stock creating an oversupply. A longer lockdown is also creating negative economic and business sentiment despite further government support. Whilst a crash seems unlikely, particularly in the typically conservative, owner occupier heavy Ku-ring-gai, there is definitely a risk of a wobble in prices in Q4. Longer term, a global economic recovery and returning immigration will no doubt sway Sydney prices again in early 2022 as vaccine targets are reached and borders re-open.

If you are considering a sale or purchase, are ready to go to market and know the next steps in your journey then lockdown may actually present a relatively stable period to buy, sell or both.

Unit Sales Across Ku-ring-gai

Please reach out if you'd like greater clarity on anything I've said. My intention was to provide some current suburb level statistics, however due to low volumes and some unusual data reportings I do not have enough confidence in the figures to publicise them and would prefer to talk 1:1 about a specific situation.

Keep well!

Josh Luschwitz - Director

0412 067 676 [email protected]

*Charts and data references were sourced from Pricefinder.

Posted on Thursday, 29 July 2021

by Josh Luschwitz in Latest News

by Josh Luschwitz in Latest News

Share This Post

Archived Posts

- September 2021 (1)

- July 2021 (1)

- June 2021 (1)

- April 2021 (1)

- March 2021 (2)

- February 2021 (2)

- December 2020 (4)

- April 2019 (1)

- December 2018 (1)

- November 2018 (4)

- October 2018 (3)

- September 2018 (4)

- August 2018 (9)

- July 2018 (8)

- June 2018 (6)

- May 2018 (8)

- April 2018 (3)

- February 2017 (2)

- January 2017 (3)

- November 2016 (2)

- October 2016 (3)

- September 2016 (3)

- August 2016 (3)

- July 2016 (2)

- June 2016 (3)

- May 2016 (4)

- April 2016 (4)

- March 2016 (4)

- February 2016 (2)

- January 2016 (2)

- November 2015 (3)

- October 2015 (1)